san mateo county tax collector property tax

The property tax extension occurs after the roll has been turned over by the Assessor to the Controller and after the County Board of Supervisors has adopted the tax rates for the current year. Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records.

San Mateo County Ca Property Tax Search And Records Propertyshark

Is green soap antibacterial.

. The median property tax in San Mateo County California is 4424 per year for a home worth the median value of 784800. San Mateo County residents may request a Homeowner Exemption claim form from this website. San Mateo County collects on average 056 of a propertys assessed fair market value as property tax.

The median property tax on a 78480000 house is 439488 in San Mateo County. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the San Mateo County Tax Appraisers office. Countywide Tax Secured 100000000.

We Provide Homeowner Data Including Property Tax Liens Deeds More. In fulfilling these services the Division assures that the County complies with. Once the Assessor or the Assessment Appeals Board makes the decision to reduce the assessed value.

With approximately 237000 assessments each year the Assessor Division creates the official record of taxable property local assessment roll shares it with the County Controller and Tax Collector and makes it publicly available. San Mateo County has one of the highest median property taxes in the United States and is ranked 45th of the 3143 counties in order of median property taxes. Residents of other counties should contact their local assessors office for these forms.

Sandie arnott tax collector san mateo county 555 county center 1st floor redwood city ca 94063 after add 10 penalty and 4000 cost toyour payment total delinquent installment due. Small business owners may be exempt from personal property tax assessment in San Mateo County if their personal property is valued at 5000 or less. San Mateo County Treasurer and Tax Collector 555 County Center First Floor.

For owners with an aggregate cost of less than 100000 the Assessor may request that a statement be filed. Where can I make my tax payment in person. Tax payments are mailed to the.

The Property Tax Division manages key aspects of the property tax process including that property taxes payable by each taxpayer are accurately calculated taxes collected are accurately distributed to taxing agencies and that any tax refunds due are processed in a timely manner. The County Managers Office provides instructions and forms for the Assessment Appeals process. Ad Find San Mateo County Property Tax Info For Any Address.

BoatVessel and Aircraft Assessments. San mateo county property tax lookup. San mateo county property tax lookupsuperhero teacher shirt The Sport for Everyone Inspiring Positive Change Pilai Bilong Olgeta Halivim Gutpela Senis salary percentile 2021.

Announcements footer toggle 2019 2022 Grant Street Group. The local assessment roll is. مارس 31 2022 آخر تحديث.

To request a claim form email the Assessor Division and include the property address your mailing address andor your Assessors Parcel Number. See Property Records Deeds Owner Info Much More. Assessor MapsTax Saving ProgramsSearch Grantee-Grantor InfoAssessor Forms.

The median property tax on a 78480000 house is 580752 in California. Total Direct Charges and Special Assessments. Dan McAllister Treasurer-Tax Collector San Diego County Admin.

Click here for Property Tax Look-up. A Telltale of Dissent. The Assessors Office website provides an explanation of the Assessment Appeals process external link.

These tax rates are also applied to the valuation assessed by the State on utility property. For more information call 6503634501. County of San Mateos Treasurer-Tax Collector offers a Secured Property Tax Search where you can find your property tax by searching by address or parcel number.

2019 2022 Grant Street Group. Taxing authority Rate Assessed Exemption Taxable Tax. Posted on March 31 2022.

Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. In melanoma research impact factor. For more information please visit the San Mateo County Tax Collectors web site.

Follow us on Instagram franco lottery winner. Ad Uncover Available Property Tax Data By Searching Any Address. San Mateo County Tax Collector 555 County Center Redwood City CA 94063.

Search Any Address 2. Property tax refunds generally result from reassessment of your property. Taxing authority Rate Assessed Exemption Taxable Tax.

Get In-Depth Property Reports Info You May Not Find On Other Sites. San mateo county property tax lookup. Berlin districts explained A Telltale of Dissent.

San mateo county property tax lookup. 0 Followers does reishi mushroom lower blood sugar. Property Tax Bills and Refunds San Mateo County Assessor-County Clerk-Recorder Elections - ACRE.

Tax payments may be paid in person to the. However they are still required to file a statement if requested by the Assessor. Sandie arnott tax collector san mateo county 555 county center 1st floor redwood city ca 94063 make checks payable and mail to.

Countywide Tax Secured 100000000. أقل من دقيقة. Hillsborough county population 2021 1.

The Assessor is responsible for determining the assessed value of all taxable property located in San Mateo County. SMC MOSQ ABATEMNT ASSMNT. You also may pay your taxes online by ECheck or Credit Card.

County Of San Mateo Government Quick Tip Tuesday It S That Time Of Year Again Secured Property Taxes Are Due By 5 P M On Dec 10 Payments May Be Made Online

San Mateo County Extends Property Tax Deadline To May 4 Climate Online

San Mateo Property Tax Deadline 5 4 Accepting Cash In Hmb Also Online Coastside Buzz

San Mateo County Postpones Property Tax Due Date Until May 4 Palo Alto Daily Post

San Mateo County Ca Property Tax Search And Records Propertyshark

Secured Property Taxes Tax Collector

San Mateo County Ca Property Tax Search And Records Propertyshark

.png?upscale=True)

Job Opportunities Job Categories It And Computers Sorted By Job Title Ascending Join The County Of San Mateo

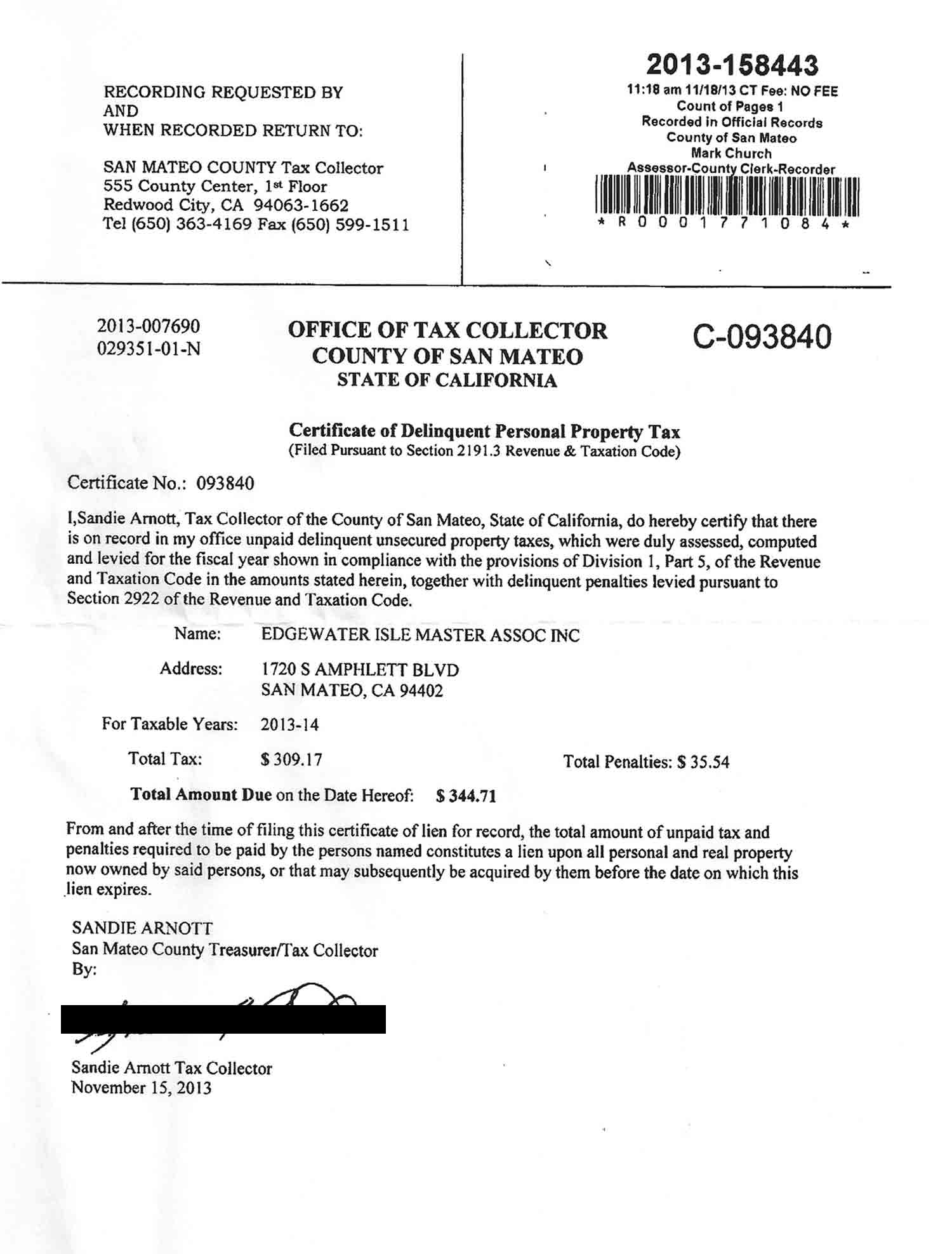

San Mateo County Issues Liens Against Master Association

County Controller Publishes Property Tax Highlights For Fy 2021 22 County Of San Mateo Ca

Secured Property Taxes Tax Collector

San Mateo Property Tax Deadline 5 4 Accepting Cash In Hmb Also Online Coastside Buzz

April 2 2021 Property Taxes Show Ninth Year Of Growth 3 Billion Distributed To Local Agencies County Manager S Office

Property Tax Search Taxsys San Mateo Treasurer Tax Collector

2018 Property Tax Highlights Publication Press Release Controller S Office